Less is More!

A blog I wanted to read prior to Series B

I decided to write this blog and share JFrog’s story with you, so if you’re doing or planning any fundraising, you’ll have these silver bullets in your pocket to whip out at any decision points along the way.

I used some “Getting Your Business Funded” blogs to enrich my knowledge prior to this round, so now that I’m “post-closing”, I’m happy to share my experience.

Before we start – Basic assumptions:

- Experience – None of the world’s successful entrepreneurs started his first company with experience! So f**k experience. If you had it you wouldn’t read this post anyway.

- Blog expiry date –Fundraising is part of the world’s economy, so don’t bother reading this blog in 2 years from now. Though some of what I’m sharing here will always be relevant, fundraising is all about here and now! I was reading LinkedIn CEO Reid Hoffman’s blog about his series B experience posted in 2004. It’s irrelevant for an entrepreneur who is looking to raise money in Silicon Valley 2014!

- Don’t bleed on VCs’ carpets – I’m sharing the experience of a company that generates revenues; we went to our series B knowing that we seek funding to fuel our growth, but are not bleeding. Trust me on this! It’s a totally different approach when you have enough money put aside. VCs’ know how to convert your “burn-rate” into “months-left” faster than you can press “Enter”! Series B should be about growing, not surviving anyway.

- Raising money isn’t fun – Your adrenaline is pumping, and you’re really excited to be talking about your company, how good you are and the success you’ve been having. However, the whole process of negotiation, paperwork, due diligence, etc., most likely, will not be much fun!

If you accept these basic assumptions, then we are good to go, and I’m guessing this blog will help you raise what we call in JFrog, “good money”.

Let’s start the journey;

Background

We are a software startup, coming from the open-source community, the creators of Artifactory and Bintray, and the home of 60 frogs that are based in Israel and California.

We have over 600 paying customers, most of them based in North America, and opened our US office in California a few months ago. Having just moved to Silicon Valley we’re experiencing “the valley” on-the-fly, and since we don’t want to fly blind, we keep listening, reading and asking, assuming that we don’t know anything!

According to our 2014 budget, we’ve planned to star JFrog’s series B and fundraising process on August this year. However, the moment we added our Silicon Valley office address to our website, phone calls started to come-in and we decided to kick-off this round earlier than expected.

I hate tips like “you take money when you can” or “you should only meet partners” 95% of the entrepreneurs I met already heard it a million times! “You want to meet decision makers and not the barking dog” as a senior partner in a well-known venture capital explained it to me. “Well Shlomi, it’s like hunting, ” he said, “We send the dogs to bark first, and when the ducks are up to the sky we aim, and we shoot!” it was a very “educational-lesson”, and I was happy that we met with senior partners, however the first thing I thought to myself was “this asshole will never sit on my board!”

We’ve also met awesome, intelligent people that just the experience of sitting with them in the same room and pitching was a joy. Not all of them liked what they heard, but it was educational and we got to know amazing people.

The 5 rules you want to follow while fundraising in 2014

So what are the Five Rules you should follow? You’d probably come with your own and with things that fits your experience. The following is what I know better today, some of it might sound obvious, still I saw too many companies getting confused when it comes to Money Vs. Shares or choosing a partner;

1. The team you are surrounded with – arriving to a meeting with a commando team and be surrounded by A level advisors is essential in series B. It puts you in a different level from the moment you enter the room and will impact the whole process!

- Your Team – Don’t hold intros’ meeting alone, you want to have your partners with you, pitch together as a team, share the presentation and know in advance what each of you present. Your partners muster their domain – you master yours. Don’t try to be a smart-guy, who knows everything, it says more bad than good things about you. No one expects to meet a 360o knowledgeable entrepreneur. Generally, I think that coming alone is worse (more, even for the sake of a feedback and learning post meeting) however, more than 2 is too much and looks like a bunch of guys that are getting excited about meeting a potential investor. A well-orchestrated, unified team is very powerful and everyone in the room will see it!

- Our advisors – I was saved by a friend who is a member of JFrog’s Advisory Board! This round included offers from $12 million to $19, it’s a lot of money and while negotiating the pre-money valuation I felt that I’m getting out of focus. I needed someone who isn’t biased, knows the company, understand the market and fundraising. I needed someone in a call-distance that will be available for me. He listened for 5 minutes to my “fundraising promo”, telling him how great we are and how much money we can get, then he stopped me and asked a simple question; “Do you really need all this money? Why do you give your company for few millions?” (read #5 to learn more about his guides). I was very close not to give this guy a call and say “leave business aside, I need your advice” I’m happy I did!

- Your Lawyer – One more player that better be a good advisor for you is your lawyer. You need an “A legal team” to escort you, you need good and loyal legal advisors that understand fundraising and understand that you are there to close a deal not to spend hours’ fight the lawyer’s ego from both sides. This is crucial for your success.

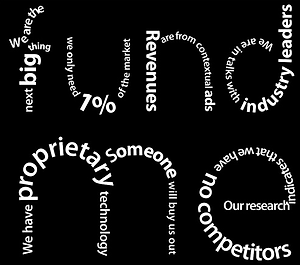

2. Your slide deck and things you don’t say

- Focus – the room is full of ego and everyone thinks they know better and saw more than you did. NO-ONE knows your company better than you, so don’t lose focus by answering every question thrown in! You can just say “I have a slide that covers this question” or “let’s get back to it…” Start with the end-in-mind, where you want to be,

present the team that you think can execute the growth, make sure your TAM story and the numbers make sense and that it’s one of your first

slides, make sure all numbers are supported by proof points, and that are all aligned. Don’t assume people appreciate the business you’ve built – they saw thousands like you, they have references, and other thoughts of what you see as great results. Bottom-line if your story fits the numbers and the team can

deliver it’s a great presentation for series B. After all, you should have shown some business growth at this point! - Elastic slide deck – Make sure not to “fall in love” with your slide deck, we met 5 VCs’ and changed our presentation 9 times. Not losing focus doesn’t mean

- that you can’t change the PPT, actually if you didn’t modify it after EVERY meeting you are in the wrong direction and probably think they are all wrong. If the

- story is not clear and flows, if the numbers are not aligned and make sense – no one will buy it. Make sure you question your presentation after every meeting! Ask for feedback from your partners and the people in the room. If you don’t the only thing you will hear is “great job, interesting company, looks like you guys

did a great job…” - Valuation – You will be asked about “numbers you had in mind”, just politely reply “you understand where we are going to, what we did and what we are planning to do – I’d appreciate your thoughts and get a number form you”

3. Partner who cares – don’t “go to bed” with just every partner because of his money. You should be clear about that from the first meeting, and when you’ll be asked about it just reply loud out “we want a partner who cares about the company in our board”. If they didn’t ask, it’s even better because you can proactively raise it as a question or expectation. Signing the check is the beginning of your relationships, from experience I can say that if your partners are someone you can trust and happy to listen and collaborate with, your life will look different. It’s not that you have to agree about everything but you all must CARE!

4. Say NO – it’s so hard, especially when you don’t have anything signed on the other side. I can only say – trust yourself and your partners, the moment the market understands you are too good to compromise you’ll get better offers. The first time we said “NO” opened the doors for us and we could even say “We received an amazing and fair offer, we just know we worth more”. Your goal is to promote a good closing not just to raise funds. Today’s (2014) money is “cheap” and it’s not about how much you raise is what deal you make!

5. You don’t lose control, You don’t lose the Board – this might be the most important advice. As I mentioned above, I was asked why do I need 12 or 19 million dollars, a question I immediately replied “you know that VC’s ballpark number is 20% control – they will not get in for less” and “I’m building the company reputation, I want people to

know that we raised a lot and that we are a well-funded company”. Bottom-line, I was wrong; we have capital aside, we are raising more now, why do I need these extra funds?! How did I get so close to the company’s share when I strongly believe will worth more in the future for such a low price?!

I’ll tell you why – it because money is so cheap today (2014), if you have a good story, team and market – it’s relatively easy to raise funds. The market pushes and expects you to raise a lot. The cool companies today are those who have raised tens of millions (GitHub, Box …just to name a few) no one care about shareholder majority, or how many BOD seats you gave. People don’t even know according to what valuation companies are raising money for. Getting “cheap money” for a good company shares is stupid (especially when you don’t need it all) keep control and the majority of shares and board seats is always important. We had the option and we raised Less for More!

Good luck!